It’s one thing to know that Total and Permanent Disability (TPD) claims exist, but it’s another to understand the reality behind them. Every number in the TPD claim statistics represents a person whose life has been changed by illness or injury, navigating the long and often overwhelming process of claiming through their superannuation.

If you’re thinking about lodging a TPD claim, you might be wondering: What are my chances of success? How often are TPD claims approved? What are the most common reasons for refusal? These aren’t just questions, these are crucial insights that can shape how you prepare your claim and protect your financial future.

In this guide, we break down the latest TPD claim success rates, refusal rates, and industry trends in Australia. You’ll see the most common reasons claims are accepted, denied, or withdrawn, and learn how understanding these patterns can give you an edge in securing the outcome you deserve.

What Are the Most Common TPD Claims in Australia?

You may be entitled to make a Total and Permanent Disability (TPD) claim if you are unable to work due to illness or injury, regardless of the cause. However, some medical conditions are far more common in TPD applications than others.

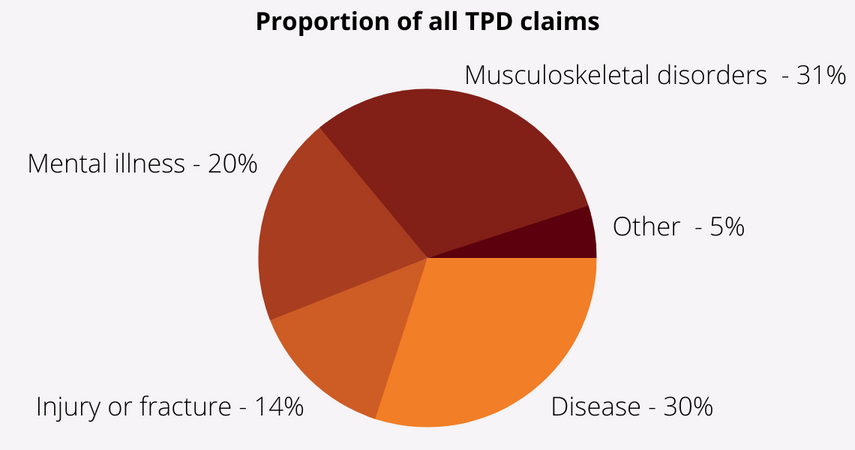

According to recent TPD claim statistics in Australia:

Musculoskeletal disorders are the leading cause of claims, making up 31% of all TPD claims. These include serious back, neck, and joint injuries that prevent a return to work.

Diseases such as cancer, heart disease, and chronic illnesses account for 30% of claims.

Mental health conditions, including PTSD, depression, and severe anxiety, make up 20% of TPD claims.

Injuries and fractures represent 14% of claims, often arising from serious accidents or trauma.

Understanding the most common TPD claim reasons can help you prepare your application more effectively, ensuring you include the right medical evidence to support your case.

What Is the Percentage of Declined TPD Claim Rates by Superannuation Insurers?

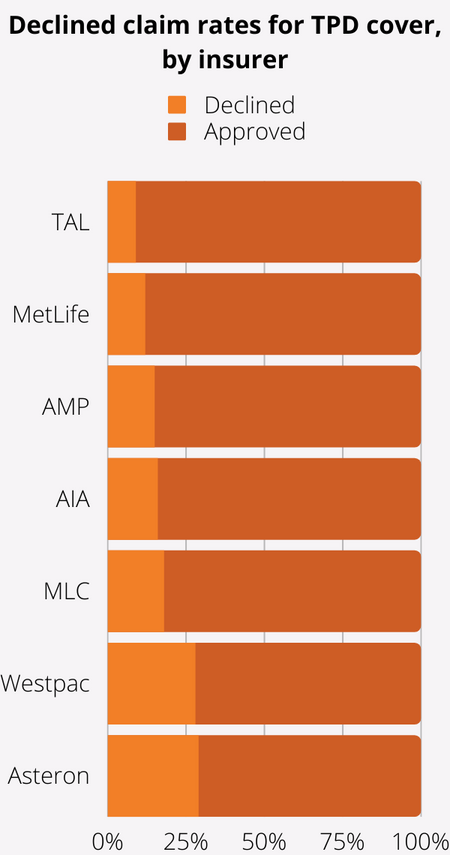

Many Australians want to know which superannuation insurance company has the best or worst record when it comes to TPD claim approval rates. While there’s no single answer, recent statistics reveal important differences between insurers’ refusal and approval rates.

Among the seven major superannuation insurers in Australia:

-

Asteron has the highest TPD claim refusal rate at 29%, meaning nearly 1 in 3 claims are not paid.

-

TAL has the highest approval rate at 91%, meaning fewer than 1 in 10 claims are refused.

It’s important to note that an insurer’s overall approval or refusal percentage doesn’t necessarily determine whether they are “good” or “bad.” Each TPD claim is unique, and results can vary based on the strength of medical evidence, policy definitions, and how well the claim is prepared.

Multiple factors can affect the outcome of your TPD claim, including the insurer’s claim assessment process, your policy wording, and the documentation you submit.

We’ve broken down the TPD claim statistics for each major insurer so you can better understand the approval and refusal trends before making a claim.

What Are the Most Common Reasons for TPD Claim Withdrawals?

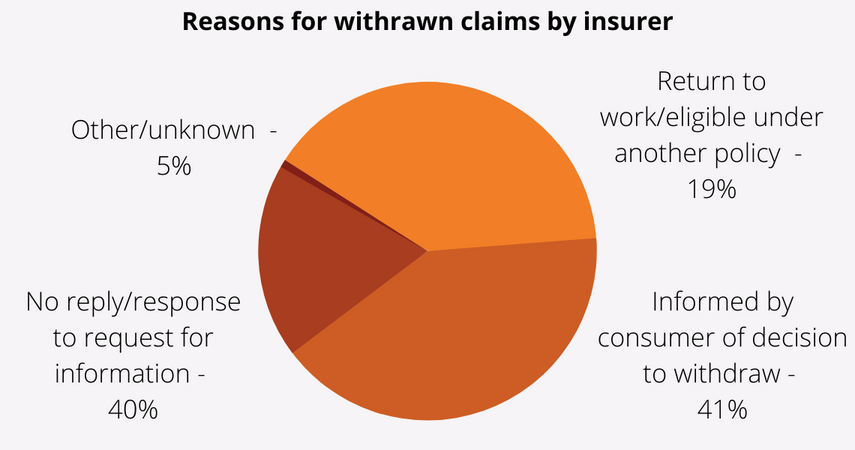

When it comes to Total and Permanent Disability (TPD) claims, not all applications proceed to an approval or refusal decision. A significant percentage are withdrawn before completion, and recent TPD claim statistics show clear patterns in why this happens.

The two main reasons account for 81% of all TPD claim withdrawals:

Consumer decision to withdraw: 41% of withdrawals occur because the claimant chooses to discontinue the process, often due to personal reasons or a belief the claim may not succeed.

Lack of response to an insurer’s request for information: 40% of withdrawals result from claimants failing to provide the additional documents or evidence requested by the insurer.

Only 19% of TPD claim withdrawals are due to the claimant returning to work, which makes them ineligible under most policy definitions.

Understanding these statistics is crucial. Many withdrawals could potentially be avoided with the right legal guidance, timely communication, and complete documentation.

Which Medical Conditions Are Refused the Most in TPD Claims?

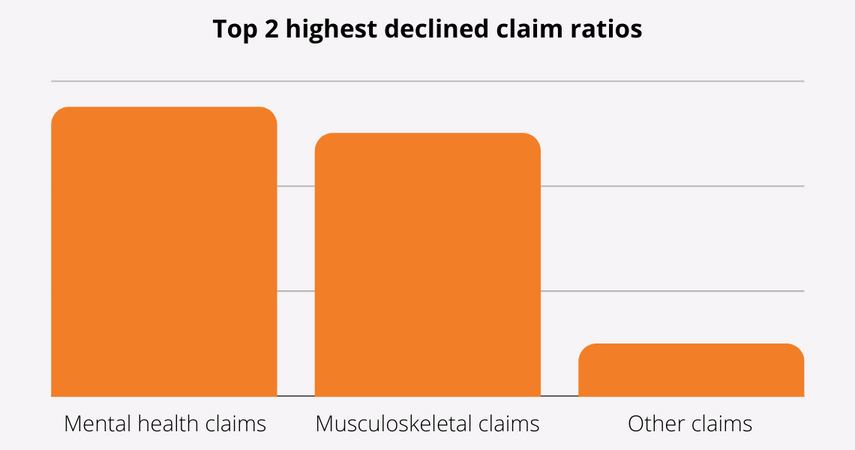

In Australia, you may be entitled to receive Total and Permanent Disability (TPD) benefits if you are unable to work due to illness or injury. However, statistics reveal that the likelihood of a claim being approved can vary significantly depending on your medical condition.

Recent TPD claim statistics show that if your claim is based on mental health conditions or musculoskeletal disorders, it is approximately five times more likely to be declined by your insurer compared to other types of conditions.

These higher refusal rates may be due to the subjective nature of symptoms, insurer scrutiny over medical evidence, and disputes about whether the condition meets the policy’s definition of total and permanent disablement.

If your TPD claim falls into one of these categories, having strong, detailed medical documentation and legal support can make a critical difference in achieving a successful outcome.

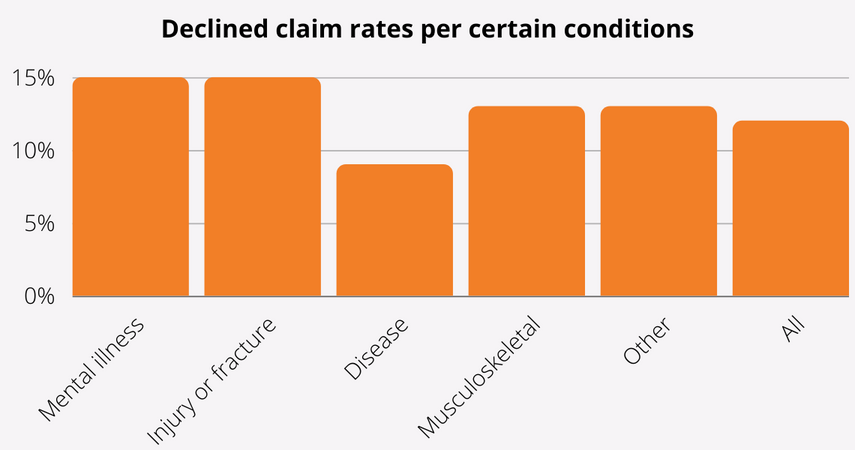

What Is the Refusal Rate of TPD Claims by Medical Condition?

Not all Total and Permanent Disability (TPD) claims have the same likelihood of success. Your medical condition can play a big role in whether your claim is approved or declined.

According to recent TPD claim statistics in Australia:

Mental illness–related claims have the highest refusal rate at 16.9%.

Fracture-related claims follow closely with a 16.1% refusal rate.

Disease-related claims, such as cancer or chronic illness, have a significantly lower refusal rate of 9.7%, almost two times lower than the highest-declined conditions.

These figures show that mental health and fracture claims face greater scrutiny from insurers, often requiring more detailed evidence to meet the definition of total and permanent disablement in the policy.

If your claim falls into a category with higher refusal rates, obtaining comprehensive medical reports and legal guidance can help improve your chances of approval.

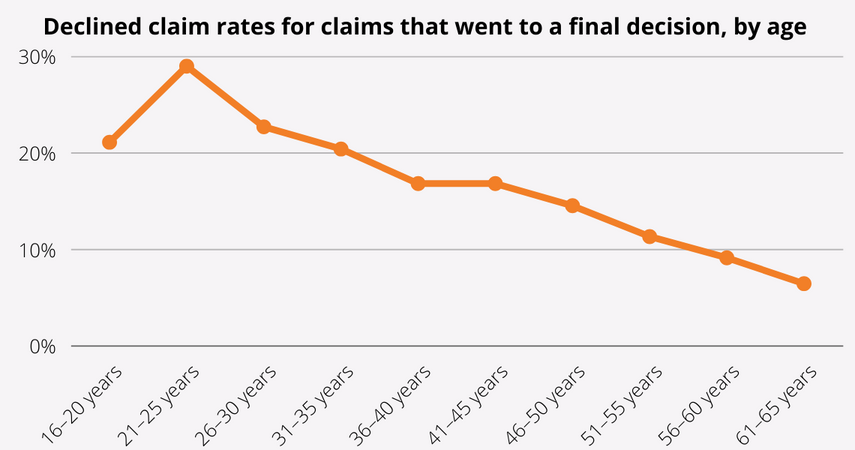

Is Age an Important Factor in a TPD Claim?

While your age is not a direct eligibility requirement for a Total and Permanent Disability (TPD) claim, statistics show a clear link between age and approval rates.

Recent TPD claim data in Australia reveals a positive correlation between the claimant’s age and their likelihood of success. The highest refusal rate is seen in claimants aged 21–25, and this rate steadily declines with age, reaching the lowest levels among claimants close to 65 years old.

This trend may be due to factors such as career length, work history, and the perceived permanence of the disability. Older claimants may find it easier to demonstrate they cannot return to suitable work, while younger claimants often face greater scrutiny from insurers.

Regardless of age, a well-prepared TPD claim with strong medical and vocational evidence can significantly improve your chances of approval.

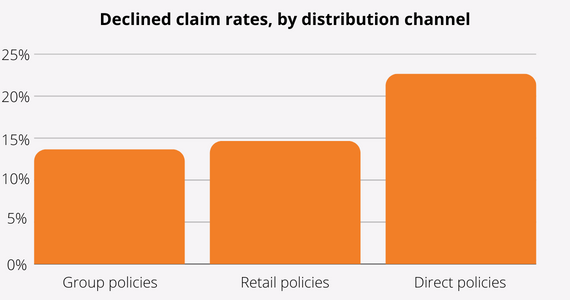

Which TPD Distribution Channels Have the Highest Decline Rates?

Not all Total and Permanent Disability (TPD) insurance policies have the same approval rates. The way your policy is set up, whether through your super fund, purchased directly, or via a financial adviser, can influence the likelihood of your claim being accepted.

Recent TPD claim statistics in Australia show:

Group policies (commonly provided through superannuation) have the lowest refusal rate at 13.6%.

Retail policies, usually purchased through a financial adviser or broker, have slightly higher refusal rates, but still perform well compared to direct policies.

Direct policies have the highest refusal rate at 22.6%, making them almost twice as likely to be declined as group policies.

These differences may be due to variations in policy wording, underwriting processes, and how claims are assessed. Understanding your policy type and its historical approval rates can help set realistic expectations and highlight the importance of submitting a well-prepared claim.

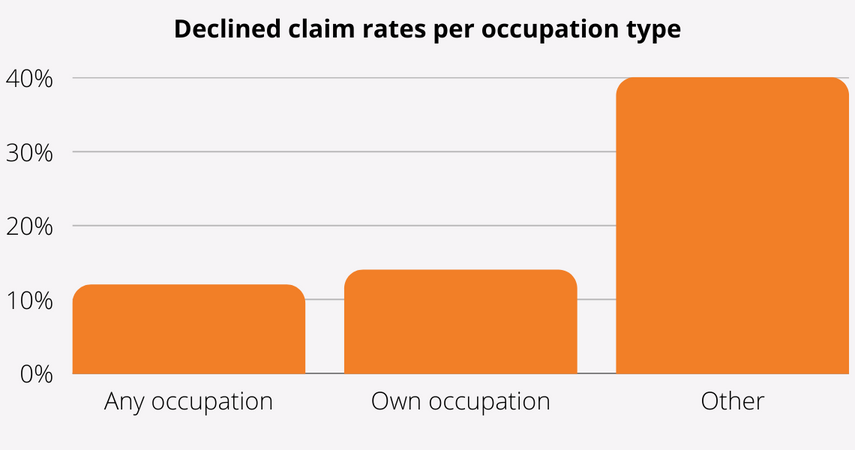

Does Your Occupation Type Affect the Success of a TPD Claim?

Your occupation type can influence the outcome of a Total and Permanent Disability (TPD) claim, but the impact varies depending on how your policy defines disability.

Recent TPD claim statistics show that the decline rate for any occupation and own occupation definitions is relatively similar. However, claims made under other occupation types experience a refusal rate three times higher than these two main categories.

This means that while the difference between “own occupation” and “any occupation” policies is minimal in terms of decline rates, being insured under a less common occupation definition may significantly reduce your chances of claim approval.

Understanding your policy’s definition of disability is crucial for improving your approval prospects.

Do Blue-Collar Workers Have a Higher Chance of TPD Claim Approval?

Your occupation class is generally not considered a major factor in determining the outcome of a Total and Permanent Disability (TPD) claim. However, recent TPD claim statistics in Australia show an interesting trend: blue-collar workers have a slightly higher TPD claim approval rate compared to other occupation classes.

While the difference is not dramatic, it may be linked to the nature of blue-collar work, where physical injuries and disabilities are often easier to demonstrate and medically substantiate under a TPD policy definition.

Regardless of occupation, the most important factors for a successful claim remain strong medical evidence, clear documentation, and meeting your policy’s specific definition of total and permanent disablement.

Am I Eligible to Make a TPD Claim If I Get Injured?

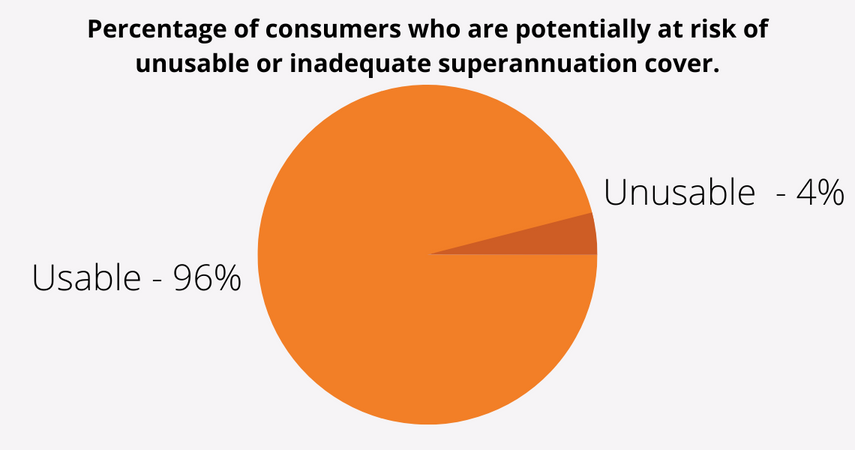

In most cases, the answer is yes. Around 96% of superannuation policies in Australia include Total and Permanent Disability (TPD) cover, which typically provides a lump sum payment if you suffer a serious illness or injury that leaves you unable to work in your usual occupation — or in any role you are reasonably qualified for.

According to recent TPD claim statistics, only 4% of consumers may not have TPD cover in their policy and therefore would not be eligible to receive benefits.

If you’re unsure whether your superannuation policy includes TPD cover, it’s important to check your fund’s product disclosure statement (PDS) or seek legal advice. Knowing your cover details can help you prepare your claim correctly and avoid delays.

What Should I Do If My TPD Claim Is Declined?

There are many reasons why a Total and Permanent Disability (TPD) claim may be declined, and in many cases it’s not your fault. Insurers may argue that you don’t meet the policy’s definition of total and permanent disablement, or they might try to pay the lowest possible amount instead of your full entitlement.

A declined claim does not mean you will never receive a TPD payout. If your TPD claim is refused, you have several options:

Request an internal review – Submit a formal complaint to your insurer asking them to review their decision.

Lodge a complaint with an external body – This could be the Australian Financial Complaints Authority (AFCA) or another relevant industry tribunal.

Commence court proceedings – This is an option in some cases, but it’s important to be aware of potential adverse costs orders.

Disputing a TPD claim decision can be complex and time-consuming. Our senior TPD lawyers have successfully helped thousands of clients challenge refusals and secure their full entitlements.

Contact Withstand Lawyers today for a free claim assessment. We’ll review the insurer’s decision, provide expert advice on your chances of success, and guide you through the process to maximise your claim.

How to Make a Successful TPD Claim Through Super

Making a Total and Permanent Disability (TPD) claim through your superannuation is not likely something you’ll ever do twice, and for many it’s a vital financial lifeline when illness or injury makes returning to work impossible. Because you can usually only claim TPD insurance once, it’s essential to get it right the first time to maximise your payout.

The process can be long, complex, and overwhelming, especially if you’re dealing with serious health issues. That’s why working with an experienced TPD lawyer can dramatically increase your chances of success. Our TPD lawyers know exactly what evidence, medical reports, and documentation are required to get your claim approved as quickly as possible.

We’ve helped thousands of Australians secure their TPD superannuation benefits, guiding them from start to finish with clear, practical advice. By letting us manage the paperwork, deal with the insurer, and fight for your entitlements, you can focus on your recovery while we focus on getting you the maximum TPD payout you deserve.

Contact us today for a free, no-obligation assessment of your TPD insurance claim.

Finding the Right TPD Lawyer

Finding the best TPD lawyer for your claim isn’t always easy — but if you’ve found this page, you’re already one step closer. At Withstand Lawyers, our TPD claim specialists have offices conveniently located in NSW and WA, and we can help you at any stage of the TPD claim process, whether you’re just starting or need help after a refusal.

We cover all upfront costs, including medical reports and other vital documents needed to support your case. And with our No Win, No Fee guarantee, you won’t pay any legal fees unless we win and you receive your TPD payout.

Our proven track record in handling TPD insurance claims through superannuation means we know exactly how to present your case to maximise your chances of approval.

📞 Call us on 1800 952 898 or fill out our free claim check form to start your TPD claim with confidence today.