Everything you need to know about TPD claims – Explained by a TPD lawyer

Too often I get compensation-related enquiries from people who do not have successful compensation claims yet are eligible for a TPD claim. To their despair but my rewarding feeling, they didn’t even know they could make a TPD claim. Here I will explain:

- What a common TPD claim looks like.

- The eligibility of making a successful TPD claim.

- What you need to know before making a TPD claim

- And how as a TPD lawyer I can help you claim TPD on a No Win No Fee basis.

What is a TPD Claim

A TPD claim is what you should start immediately if you are unable to work due to an injury or illness. It can be claimed through your superannuation fund if the TPD insurance was active when you last worked or suffered the injury or illness.

If your account balance is low and you think it’s related to your account balance, then you are mistaken!

TPD Insurance, what is that?

TPD is short for total, permanent disability. It’s a type of insurance that is offered and mostly included in peoples’ superfunds. Think like life insurance but instead is claimed due to being unable to work due to an injury or illness. That injury or illness does not need to be work-related and it does not need to be due to someone else’s fault.

So, if something happens to you and you’re unable to work due to an injury or illness, you can claim TPD as a lump sum payment through your super fund.

TPD claim eligibility

To be eligible, you first need to have or have had TPD Insurance in your Superannuation policy as of the date you last worked or were unable to work due to injury or illness and continue to be unable to work within your education, training, or experience.

Not any job in the world, just the job that you have had education, training or experience. If you always had active TPD insurance then you can check your superannuation statement, or a call to your Superannuation fund can answer this for you but get it in writing. You should also double-check to ensure you are not given the wrong advice as the superfund could say you don’t have TPD Insurance when you call but you need to know if you had it on the relevant date.

Alternatively, you can reach me on 1800 952 898 for a free claim assessment and we can find out and advise you on your eligibility, for free.

What a common TPD claim looks like

You were receiving super contributions and had active TPD Insurance; and was working but stopped working due to an injury or an illness which continues to stop you from being unable to work within jobs that you are either educated, trained or experienced to do.

What you need to know before making a TPD claim

If you’re reading this, then you’ve probably answered yes to the questions above- if so, then you may be eligible to claim your TPD benefits, and the complex process begins. Here’s where I can help.

Once you (or I) establish that you have TPD Insurance, the next step is to review your superannuation policy to see what the eligibility requirements are and see what exclusions apply. If you satisfy the criteria, then the next step is to gather evidence in support of your TPD claim. In short, you’ll need to:

- Contact the superfund and obtain a copy of their claim forms.

- Read the terms and conditions and see how you meet them;

- Complete the claim forms as thoroughly as possible.

- Gather evidence that proves your disability and meets the terms and conditions.

- Submit it to the insurer and wait for a decision.

Our TPD lawyers and I can help you get your claim over the line quickly, having successfully lodged many TPD claims over decades, we’re familiar with what the superannuation fund and insurer should expect and do it on a No Win No fee basis.

Common reasons why TPD claims are rejected

A TPD claim may be denied for one or more of the following reasons:

- Failing to meet the policy definition.

- Not meeting the work history requirement.

- The evidence you’ve provided may be disputed.

- Not meeting the minimum waiting requirement.

- Your policy becomes inactive because you haven’t kept up the premium payments, closed your account, or it has lapsed.

- Lodging your claim outside of the time.

- Errors or inconsistencies in your evidence.

We’re here to help you by ensuring that your claim is strong and well-supported, reducing the risk of denial.

John’s TPD claim and why he swears by TPD

John called us one year ago. It was a Sunday morning when he rear-ended another vehicle. John injured his lower back pretty badly (5 disc protrusions)!

He called enquiring what his entitlements were and after getting over being unable to claim a payout because he was at fault, I enquired whether he was employed. I also asked what type of work he had education and experience in and about 20 minutes later I realised he may be eligible to make a TPD claim. Although it could be argued that John could work in an office environment, he had no education, training, or experience in anything except as a labourer and other physically laborious roles that I would never be able to do!

Turned out, John also was suffering from arthritis and bad knees as a result. I told him about our free TPD claim assessment which involves sending authorities to make enquiries with the superfund he was a member of to find out the details of his policy as explained above. Eight months later, we claimed the TPD Insurance in his superfund which was $150,000 and received a TPD claim acceptance decision from his super fund. John was happy and now makes sure his family and friends all have TPD Insurance because he swears by it.

What are the most common injuries and illnesses for a TPD claim?

There are a range of illnesses and injuries that may qualify for a TPD claim, including but not limited to

Physical injuries

- back injuries

- loss of limb or hearing

- carpal tunnel

- organ failure

- paraplegia

- quadriplegia

Psychological/mental health

- Anxiety

- Depression

- Bipolar Disorder

- Post-Traumatic Stress Disorder (PTSD)

Neurological disease

- Multiple sclerosis

- Motor Neurone Disease

- Cancer

- Muscular Dystrophy

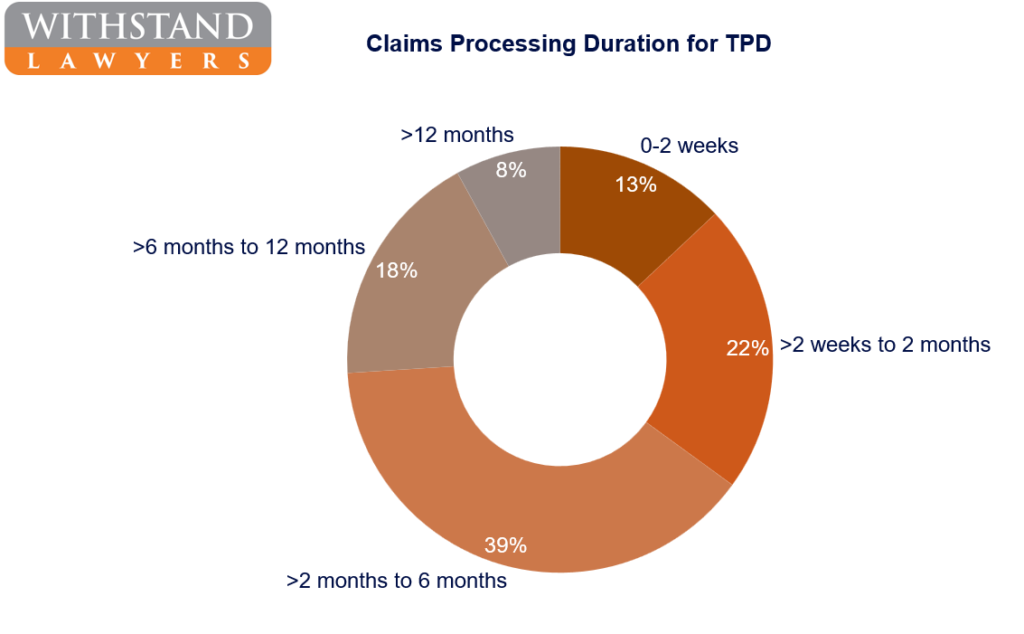

How long does a TPD claim take?

Generally, it takes 6-12 months for a TPD claim to be finalised. If your circumstances are straightforward, it is more likely to be finalised sooner, however the more complex claims often take longer than 6 months to make a decision.

Our TPD lawyers can have your claim sooner and start the clock running.

Call us for free advice on 1800 952 901 if you’re thinking of making a TPD claim.

Can you claim on multiple TPD policies?

If you have multiple superannuation funds, you may have multiple TPD Insurance policies and be able to make multiple claims, one for each policy.

The only thing is that you will need to satisfy each definition for each fund and submit a separate claim for each policy. If you’re not sure how to proceed, or if the thought of it is making you feel overwhelmed, contact our TPD who can help guide you through the process.

How to make a TPD claim step by step?

Here’s a step-by-step breakdown of the TPD claim process:

Step one – identify all of your superannuation policies

If you are unsure which superfunds you could be a member of please contact our TPD lawyers who will be able to assist you in identifying which superfund you could be a member with.

Step two – check the policy validity at the time of your injury/illness.

To make a TPD claim you must ensure that you had valid cover at the date of your injury or illness. This is not always black and white, as the date of injury or illness may be one that occurred over time. Our TPD lawyers during our free claim check will be able to check whether it is valid and whether you will be eligible prior to you making the TPD claim.

Step three – Read and understand the TPD policy including the TPD insurance definition, insured benefit and eligibility.

You should read the policy throughly to identify what is required to receive a lump sum payout.

Step five - Prepare written submissions explaining why the claim should be approved.

The submission should be detailing why your TPD claim satisfies the criteria in the TPD policy and why it should be approved.

Step six – Be proactive and confirm with the insurer that they have everything they need to make a decision.

Follow up with the insurer to avoid unnecessary delay

Step seven – If your claim is denied, follow up the dispute process.

If your TPD claim is denied, you may dispute the decision. Our TPD lawyers have successfully disputed many claims on behalf of our clients.

Do we need a lawyer to make a successful TPD claim?

TPD claims can be a challenging and confusing process for many people. Fortunately, our team of highly skilled TPD lawyers can help manage your claims and increase your chances of success, while taking the burden of paperwork and dealing with insurers off your shoulders.

We have a track record of successfully managing hundreds of TPD claims, giving us an in-depth understanding of the process and the evidence needed to get your claim approved – first go! Call us on 1800 952 901 today to get the process started.

TPD Payouts

How is a TPD payout calculated?

The amount of TPD you receive depends on how much coverage you purchase and is specified within your policy. You can find your insured benefit amount by reading your policy or looking at your most recent super member statement. Typically, the TPD payout can be between $40,000 to $2,000,000.

If you make a successful TPD claim, you may be given the option to withdraw this amount in addition to your superannuation account balance. It is important, however, to recognise that there may be financial/tax implications depending on specific factors. Although our TPD Lawyers are unable to provide you with financial advice, we can assist you in ensuring you get the right advice prior to withdrawing your TPD benefit.

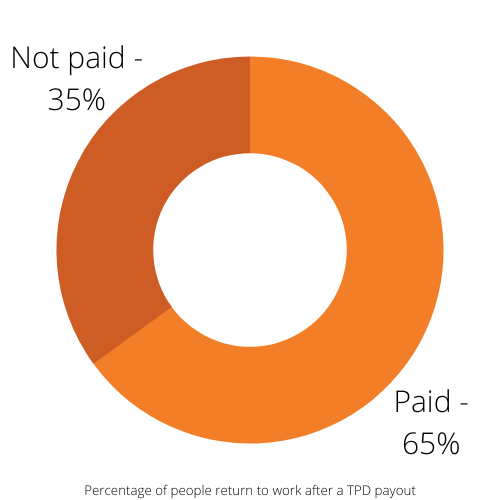

What percentage of people return to work after a TPD payout?

The available data is limited but a survey of SunSuper claims that 22% of the people who received a TPD payout returned to full or part-time work after a TPD payout.

Furthermore, 14 % of the respondents were looking for a job. Such claimants might have gotten medical treatment that was not available before their claim is settled or they started working.

Is a TPD payment taxable?

Simply put, a TPD payment is not considered taxable income however if you withdraw any part of your TPD payout from your super fund as a lump sum, then you will be liable to “superannuation lump sum withdrawal tax” unless you are aged 60 or over.

The amount payable varies for each person and if you have multiple TPD claims. To obtain information and advice based on your circumstances, we recommend you understand the details below and seek financial advice prior to withdrawing any TPD insurance super payout, upon receipt of a successful decision from the insurer. Our TPD lawyers can connect you with advice on tax and its implications on your TPD payout we do not provide any financial advice as TPD lawyers.

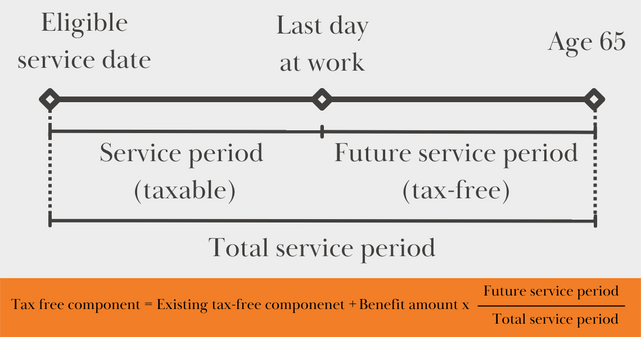

TPD payout tax calculator

The figure and formula below shows, generally, as an example only, on how TPD payout tax is calculated. Let’s break down the definitions and mathematical operations.

Definitions

What is the ‘Eligible service date’?

According to the ATO, the eligible service date can be either

- the first day of the first period of employment that the lump sum relates to if the member was employed when some or all the lump sum accrued

- the earlier of the following if the member was not employed when some or all of the lump sum accrued;

- the date when the member joined your fund

- if the lump sum is attributable to an earlier lump sum previously rolled over, the first day of the service period of the earlier lump sum.

What is the ‘Last day at work’?

According to the ATO, the last day at work refers to the date you stopped being eligible of being gainfully employed. Generally, this is your employment termination date, rather than the date you got injured or sick.

What is the ‘Total service period’?

The total service period is the time between the age of 65 and the beginning of the eligible service day. As an example: if the eligible service day is 1/3/2000 and the person turns the age of 65 on 1/3/2032, the total service period is 32 years or 11,688 days

When do you pay tax on TPD insurance payout?

Eligible Service Date, age, and the date last worked are the most important factors on when tax is paid. Three main cases are as follows:

- If you are 60 or over, there is no tax payable

- If you are under the preservation age, – which is 55 and 60 depending on your date of birth- then you will pay tax on a portion of it and a tax-free portion will be calculated.

- The standard tax rate is 22% HOWEVER when you make a withdrawal, the superannuation fund will calculate a “tax free uplift”, meaning a portion of your withdrawal will be tax free. The calculation will take into consideration your Eligible Service Date and age, as well as the date last worked.

Is the calculation the same for TPD payments?

The answer is yes for the calculation process and criteria. However, given that the payments are different, the calculation of the tax on the TPD payment will be different for everyone.

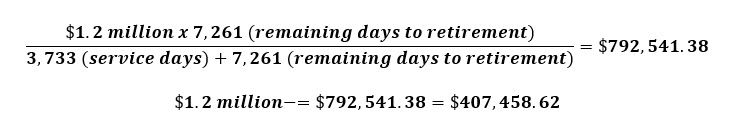

An example could be more explanatory. Let’s have a look at how Joshua’s lump sum of TPD benefits is calculated.

Example TPD tax calculation

Joshua, age 48 (date of birth 13 March 1976), has $200,000 in super with any occupation TPD cover of $1,000,000. Joshua suffers an injury and becomes eligible to receive TPD payment from the superannuation fund.

He has $1.2 million within the account as a taxable component. He makes a TPD claim and asks his superannuation fund to release the benefits. He wants to receive the full amount as a lump sum payout, and he is aware of the tax consequences if the payment date of the lump sum is 1 June 2021.

The start date of Joshua’s superannuation fund is 13 March 2011. The trustee generally assumes a person would retire at age 65, that is, on 13 March 2041 for Joshua. According to the information above, the tax amount calculation will be as follows:

Service Days = 3,733 (18 April 2011 → 1 June 2021)

Remaining days to retirement = 7,261 (1 June 2021 → 13 March 2041)

The remaining amount of the lump sum is $407,458.62, and it is all a taxable component.

As Joshua is under preservation age, the taxable component of $407,458.62 is added to assessable income and taxed at a maximum rate of 22%, which makes $89,640.89 tax payable. That means Joshua’s net benefit will be $1,110,359.10.

What does TPD insurance cover?

TPD insurance provides a lump sum payment if you are unable to work due to injury or illness.

Do I need TPD insurance?

Whether or not you need TPD insurance is a matter for you to decide, it is not compulsory. TPD insurance can however, be a financial lifeline in circumstances where you might be struggling due to an inability to work. That is, you should consider what you would do financially if you were unable to work due to an injury or illness.

How much TPD insurance do I need?

How much TPD cover you will need is dependent on your circumstances and how much your expenses are. We recommend taking our TPD cover that is proportionate to your expenses. That is, consider what expenses you will need to cover if you became permanently disabled and unable to work including (but not limited to) your;

- mortgage or rent repayments;

- debt repayments including credit card and car debt/finance repayments;

- medical and rehabilitation expenses;

- living expenses for you and your family;

- savings that you want for retirement.

You should also consider whether you have other means to help you pay for the above expenses including:

- private health insurance for medical expenses;

- income protection for time off work;

- any savings you have or can acquire by selling assets;

- what kind of support your family and friends can provide.

Your TPD insurance premium will vary depending on the level of cover you hold.

Is TPD insurance tax deductible?

Your premiums are not tax deductible if you purchased your TPD insurance through and insurance company rather than your superannuation fund. However, if you have TPD insurance through your superannuation fund, then you may be eligible for a full or partial deduction.

Are TPD payments taxable?

Your premiums are not tax deductible if you purchased your TPD insurance through and insurance company rather than your superannuation fund. However, if you have TPD insurance through your superannuation fund, then you may be eligible for a full or partial deduction.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Free Initial Consultation

Related blogs

Are You Getting What You Are Supposed to From Your TPD claim?

Before looking at what consumers are getting out of their TPD insurance and the effectiveness of their policies, it is important to define Total and

Total & Permanent Disablement (TPD) Superfund in Australia

What is TPD insurance in super? Superannuation, or just super, in short, refers to benefit funds for retirement. Employers are required to make payments to

When Should I Settle My Personal Injury Claim?

This is understandably one of the hardest decisions you would need to make in your personal injury claim. Regardless of whether it’s a car accident claim,