When considering financial protection if you’re unable to work, understanding the difference between TPD and Income Protection insurance is crucial. Both types of insurance offer support during tough times, but they work in different ways.

- TPD Insurance (Total and Permanent Disability): Provides a one-time lump sum payout if you become permanently unable to work in any job suited to your education, training, or experience. It’s designed to help cover long-term expenses, like paying off a mortgage or funding ongoing medical care.

- Income Protection Insurance: Offers a regular income, typically a percentage of your salary, if you’re temporarily unable to work due to illness or injury. This type of insurance is intended to cover everyday expenses until you can return to work or reach the policy’s end date.

Knowing how TPD and Income Protection insurance differ can help you choose the best coverage for your needs. In this article, we’ll break down both options, explore their benefits, and help you decide which one is right for you.

What is TPD Insurance?

TPD insurance, or Total and Permanent Disability insurance, is designed to provide a financial safety net if you’re permanently unable to work due to a severe injury or illness. In simple terms, if you can’t return to any job suited to your education, training, or experience because of your condition, TPD insurance can pay out a one-time lump sum.

This payout can be used to cover a range of long-term expenses, such as:

- Paying off your mortgage or other debts

- Funding ongoing medical treatments or rehabilitation

- Modifying your home to accommodate new physical needs

- Supporting your family’s financial well-being

The goal of TPD insurance is to give you and your loved ones some stability and financial security at a time when your income is no longer reliable. This is why most Aussies have TPD cover bundled automatically in their super, even if they don’t know they do.

What is Income Protection Insurance?

Income Protection insurance offers a different kind of financial safety net compared to TPD insurance. Instead of a one-time lump sum, it provides a regular income to someone who is temporarily unable to work due to illness or injury. As a superannuation insurance benefit, Income Protection payments are designed to help cover everyday living expenses while you recover.

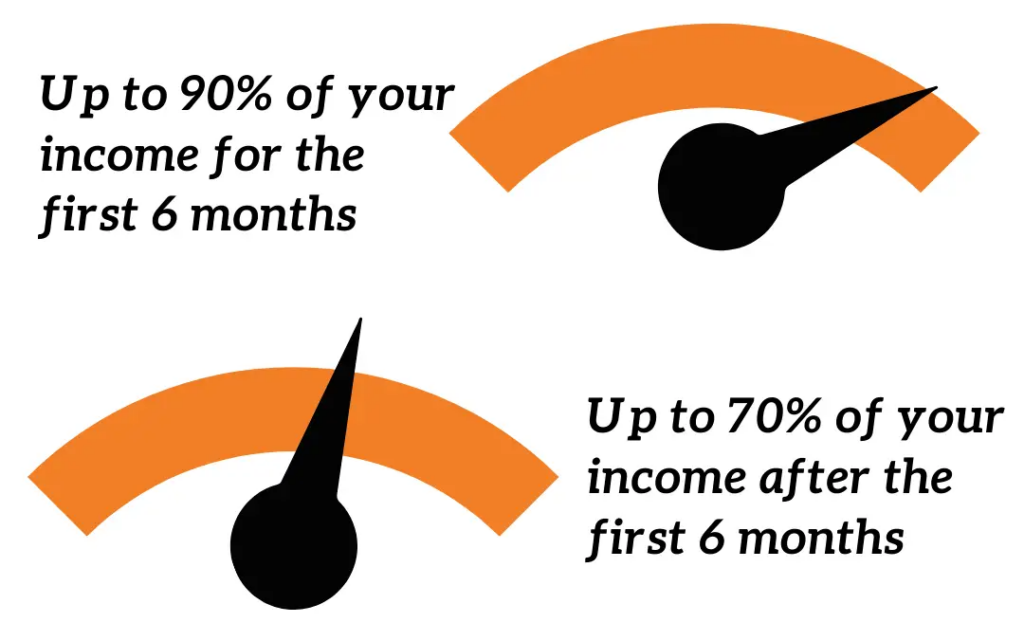

The amount you receive and the duration of the payments depend on the specifics of your policy. Typically, up to 95% of your pre-injury income may be paid during the first six months, with the benefit amount reducing to around 70% after that period.

The length of time you can receive these benefits also varies. Depending on your policy, payments could continue for a set period—such as two or five years—or up until a specified age, like 65. The exact terms are outlined in your superannuation insurance policy, so it’s important to understand your coverage details.

The Key Differences Between Income Protection vs TPD Insurance

| Income Protection | TPD |

|---|---|

| Can be claimed when you are unable to work | Can be claimed if you are no longer able to work in your usual or any occupation based on your education, training and experience |

| Pays a monthly benefit, during a predetermined period | Usually pays a lump sum payment |

| Benefits include up to 95% of the pre-injury income for a period of time of usually 2-5 years | Benefit payouts amount typically range between $70,000 – $2,000,000 |

While not all superannuation funds automatically provide coverage for both, you can opt to have both TPD Insurance and Income Protection to better secure your future. Having both types of coverage can offer greater financial benefits if you become unable to work, providing comprehensive support for your needs.

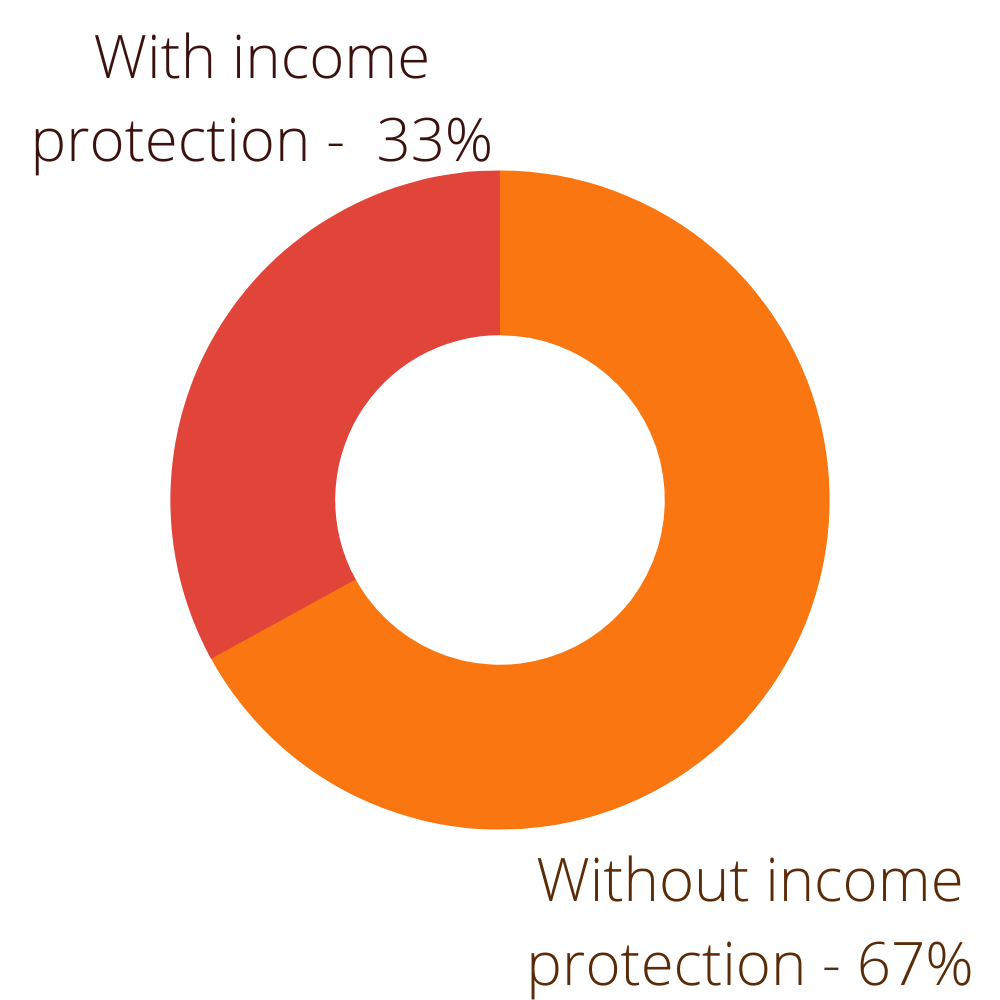

What percentage of Australians have income protection insurance?

According to Rice Warner’s report in 2017, only 33% of Australians have income protection that can financially support them if they become unable to work.

How Do I Make an Income Protection Claim?

1. Notify Your Employer and Superannuation Insurer

As soon as you become unable to work, it’s important to reach out to both your employer and your superannuation insurer to initiate your income protection claim. Your insurer will guide you through the process and send you the necessary paperwork to get started.

2. Obtain a Statement from Your GP

Request a detailed statement from your GP confirming that you are unable to work due to your medical condition. This statement will be a crucial piece of evidence to support your claim.

3. Complete the Income Protection Claim Form

Fill out the income protection claim form provided by your superannuation insurance company. Make sure to include all required documents, such as the GP statement, work history, recent payslips, identification, and any other relevant information. If you find the process overwhelming, our TPD lawyers are here to assist you. We often lodge income protection claims alongside TPD claims for our clients, ensuring everything is handled smoothly.

4. Wait for the Outcome

Once you’ve submitted your claim with the correct supporting documentation, your next step is to wait for your insurer’s response. Be aware that most policies have a waiting period of 0 to 90 days before payments can begin.

What Should I Do If My Income Protection Claim is Refused?

Having your income protection claim denied can be incredibly stressful, especially when you’re already dealing with the challenges of illness or injury. However, a denied claim doesn’t have to be the end of the road. Here’s what you should do if your income protection claim is rejected:

Review the Denial Letter Carefully

Start by reading the denial letter from your insurer in detail. The letter should outline the reasons your claim was rejected, which could include insufficient medical evidence, failure to meet policy conditions, or a pre-existing condition exclusion. Understanding why your claim was denied is crucial for planning your next steps.Gather Additional Evidence

If your claim was denied due to a lack of evidence, you might be able to strengthen your case. Speak with your healthcare providers and request additional or more detailed medical reports that clearly explain your inability to work. Consider including documentation from specialists if applicable, as their input can carry significant weight.Check for Policy Misinterpretations

Sometimes, claims are denied because the insurer misinterpreted your policy terms or medical situation. Review your policy and compare it with the denial reasons to ensure that the insurer’s interpretation aligns with what your coverage should offer. If you notice any discrepancies, make a note of them.Request a Review or Appeal

Most insurance companies have a process for appealing denied claims. You can formally request a review and provide the additional evidence you’ve gathered. Be sure to adhere to any deadlines specified in the denial letter, as missing these could harm your chances of a successful appeal.Seek Legal Assistance

If your appeal is complex or if you’re unsure about how to proceed, consulting with a TPD or income protection lawyer can be highly beneficial. A lawyer can review your case, identify weaknesses in the denial, and help you build a strong argument. Our team at Withstand Lawyers have decades of experience dealing with insurers, and can guide you through the process to improve your chances of a successful outcome.

Success Stories: Real Example of a Successful Income Protection Claim

The Case

Liam, a 48-year-old dad juggling the responsibilities of raising three kids, had built a stable life for his family through his work as a bookkeeper, earning $90,000 a year. But in 2020, a sudden and serious back injury struck while he was at home, leaving him in pain and unable to work. To make matters worse, the nature of the injury at home mean that Liam wasn’t eligible for any personal injury claim. The situation left him facing both physical challenges and financial uncertainty.

The Outcome

Thankfully, Liam had income protection insurance, which became his financial lifeline while he was stuck at home and unable to work. The insurance provided him with monthly payments to cover his daily expenses and support his family. During the first six months, he received $6,180 each month—90% of his pre-injury salary. After the sixth month, the payments adjusted to $5,150, equaling 75% of his previous income.

When he finally recovered and was ready to get back to work, the income protection payments stopped. But during those challenging months, the financial support made all the difference, allowing him to focus on healing without the constant worry of bills piling up.

TPD was not a factor in Liam’s case as he was able to return to work in his field.

To read about injuries that lead to TPD claims, click here.

Reach our Superannuation Lawyers for a Free Claim Check

Our experienced superannuation lawyers specialize in income protection claims and offer a free claim check to assess your case if you are injured or unable to work. We work on a No Win, No Fee basis, meaning you’ll only be charged if we successfully win your case, and you won’t pay any upfront costs.

Our TPD lawyers proudly serve clients across Australia, as the laws governing TPD and income protection are Commonwealth-based, not state-specific. Whether you’re just starting your superannuation claim or facing hurdles along the way, we’re here to help ensure you receive your full entitlements as quickly as possible.

Reach out to us anytime at 1800 952 901 or fill out our free claim check form, and our team will get in touch to assist you.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society