Ever wondered if your condition would qualify for a TPD claim? You’re not alone. Trying to navigate the world of Total and Permanent Disability (TPD) claims in Australia can feel overwhelming, especially when you’re already dealing with the emotional and physical impact of your illness or injury. Knowing what’s commonly accepted can give you a clearer picture of where you stand.

According to ASIC, approximately 9 million people in Australia have Total and Permanent Disability (TPD) insurance within their superfund. As a TPD lawyer in Australia, I’ve had the privilege of working with clients whose lives have taken some unexpected and painful turns. When the worst happened, many of them felt like they’d hit rock bottom—until a successful TPD claim became their financial lifeline. It’s been incredible to witness the relief and hope that can come from securing that support when it’s needed most.

In this article, I’ll share examples of the most common TPD claims I’ve seen in our practice. Along the way, I’ll also give you a few insights into what makes these cases successful and how they’ve helped people regain some stability during incredibly tough times.

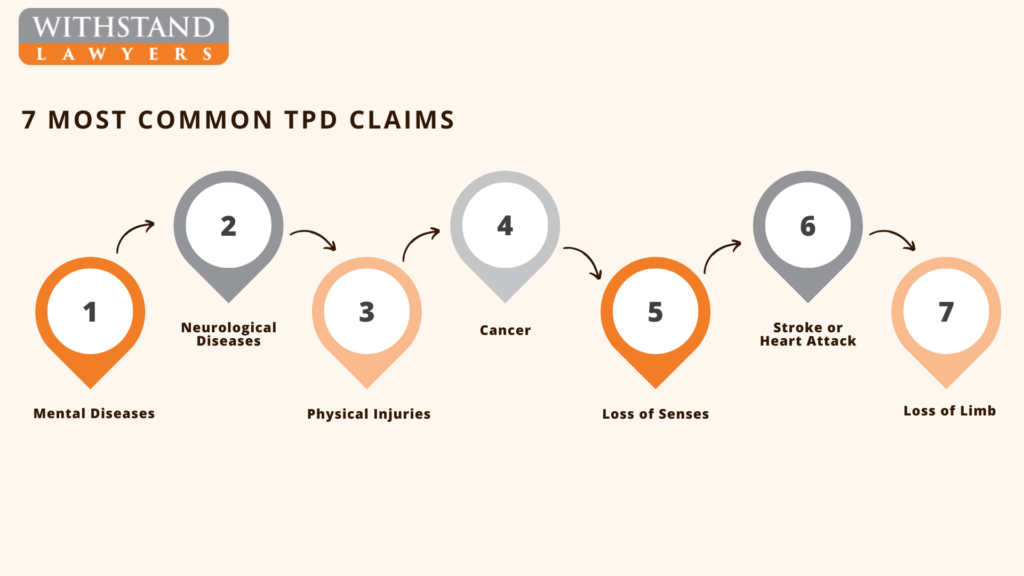

TPD Claims Example #1:

Depression and Mental Illness

Mental health conditions are an invisible but incredibly heavy burden, affecting even the most resilient people across all walks of life. From depression and post-traumatic stress disorder to schizophrenia, the impact can be devastating, stripping away not only your ability to work but also your sense of purpose and stability. Whether you work in a high-stress corporate role or in a physically demanding blue-collar job, mental illness doesn’t discriminate.

Over the years, I’ve acted for many clients who have successfully made TPD claims due to their mental health conditions. These cases aren’t easy, but they’re some of the most important. I’ve seen firsthand the toll these conditions take, and I’m passionate about advocating for my clients and working tirelessly to convince super funds and insurers of the reality of their situation. The relief on a client’s face when their claim is finally approved is unforgettable, especially when that financial lifeline comes at a time they need it most.

If you’re unable to work due to a mental health condition, it might comfort you to know that a TPD claim could be an option. You may be eligible for a payout through your superannuation fund, and it’s separate from your account balance. The amount you could claim depends on your TPD insurance coverage at the relevant time, but payouts typically range from $50,000 to $350,000.

If you’re unsure about your eligibility or don’t know where to start, let’s take that step together. Reach out for a free claim check, and we’ll discuss your situation and see how we can help.

TPD Claims Example #2:

Neurological Diseases

Neurological diseases like Multiple Sclerosis (MS), Motor Neurone Disease, and brain cancers can have a profound impact on your ability to work and, often, on your overall quality of life. In my professional experience, claims related to neurological conditions are among the most common TPD claims we handle. These cases are challenging but incredibly important, as they often involve people facing immense physical and emotional struggles.

What makes neurological diseases unique in the context of TPD claims is that they’re typically no one’s fault. Unlike workplace or car accident injuries, these diseases just happen, and they don’t come with an option for traditional compensation. That’s why securing a TPD payout becomes crucial for financial relief. One of the most rewarding moments in my work is when someone comes to us believing their condition isn’t covered, only for us to uncover that their neurological disease makes them eligible for a TPD claim. It’s life-changing news, and I’m always grateful to be able to deliver it.

If you’re suffering from a neurological condition that’s making work impossible, know that you could be eligible to make a TPD claim—provided you had TPD insurance coverage when you were last employed. These claims can be complex, but having an experienced team to guide you can make a world of difference.

Unsure if you qualify or need more information? Reach out for a free claim check, and we’ll assess your situation at no cost.

TPD Claims Example #3:

Physical Injuries

Musculoskeletal injuries are a frequent cause of TPD claims, and they can completely derail your ability to work and live as you once did. These claims often involve conditions such as:

- Back injuries that leave you unable to lift, bend, or sit for extended periods.

- Joint pain that turns simple movements into unbearable tasks.

- Repetitive strain injuries that build over time, often from years of physical labor.

One of the most important things to understand is that it doesn’t matter if your injury was caused by an accident, your work environment, or simply the wear and tear of life. The key factor for a successful TPD claim is whether the injury prevents you from working within the scope of your education, training, or experience.

Context is everything. Take, for example, a lower back injury. If you’ve spent your career working as a laborer and that’s your only professional experience, your injury could make it impossible to transition into a sedentary role. This reality often makes physical injuries a strong basis for TPD claims. I work closely with my clients to ensure that their claims are backed by comprehensive evidence and presented persuasively to super funds and insurers.

If a physical injury has made it impossible for you to keep working, you might be eligible for a TPD claim. The process can feel complex, but having an experienced advocate on your side can make all the difference. Reach out to discuss your situation, and together, we’ll work to secure the support you need.

TPD Claims Example #4:

Cancer

Cancer. It’s a word that strikes fear into the hearts of many, and for good reason. According to the Cancer Council, more than 150,000 Australians were diagnosed with cancer in 2021. While cancer tends to be more common with age, making younger TPD-related cancer cases less frequent, it still stands as one of the most common TPD claims we handle.

The truth is, cancer doesn’t just impact your health; it can throw your entire life into chaos, making work feel like an impossible burden. Many types of terminal or advanced-stage cancer qualify for TPD benefits because they leave you physically and emotionally drained, unable to continue in your professional role. Even the treatments themselves—surgery, chemotherapy, and radiotherapy—take a toll that makes sustaining any kind of employment nearly impossible.

A successful TPD claim can be a critical lifeline during this overwhelming time. The payout from your insurance policy isn’t just financial relief; it’s the reassurance that you and your loved ones will have support while you focus on your health. If you or someone you care about is facing cancer and wondering whether you might qualify for TPD benefits, don’t hesitate to reach out. We can help evaluate your claim and guide you through every step of the process, making sure you get the support you need.

TPD Claims Example #5:

Loss of Senses

The loss of senses, such as sight or hearing, can be life-altering in ways many of us don’t even imagine until we or someone we know experiences it. Claims related to the loss of senses are a common type of Total and Permanent Disability (TPD) claim, and they highlight just how devastating these impairments can be to a person’s livelihood and independence.

The causes vary—sometimes it’s the result of a stroke, sometimes a battle with cancer, and in other cases, it’s a sudden accident, like a workplace incident or car accident. No matter the cause, the impact is profound. Losing your vision or hearing doesn’t just make everyday tasks difficult; it can entirely prevent you from continuing in your chosen career, especially if your role heavily relies on those senses.

When faced with such a loss, navigating the financial and emotional consequences can feel overwhelming. But if you find yourself in this situation, you may be eligible to make a TPD claim through your insurance policy. The process involves demonstrating how your sensory loss affects your ability to work and live independently.

If you or a loved one is struggling with the loss of sight or hearing and wondering if you might qualify for a TPD claim, don’t hesitate to reach out. We’re here to walk you through your options, explain the steps involved, and support you in securing the financial assistance you deserve.

TPD Claims Example #6:

Heart Attack and Stroke

Cardiological conditions, like strokes or heart attacks, are some of the most life-changing experiences anyone can go through. They’re also among the most common TPD claims we see. Every day, around 150 Australians suffer from a stroke or heart attack, and the aftermath can make even the most basic tasks feel impossible, let alone maintaining a full-time job.

When a heart condition strikes, your ability to work often takes a major hit. Depending on the severity and lasting effects, you might find that you’re unable to continue in your role, whether it’s physically demanding or even mentally taxing. This is where a TPD claim can come into play, offering financial relief and a sense of stability during an incredibly uncertain time.

What’s crucial to understand is that the eligibility for a TPD claim in cases of stroke or heart attack often depends on the extent and duration of your impairment. Some people recover enough to resume their duties, while others face long-term limitations that prevent them from ever returning to their previous line of work.

If you or a loved one has experienced a stroke or heart attack and are wondering about your eligibility for TPD benefits, reach out to us. We can help assess your situation, explain your options, and guide you through the process to ensure you have the support you need as you focus on your recovery.

TPD Claims Example #7:

Loss of Limbs

Losing a limb or even part of one is a devastating experience that can turn your entire world upside down. It’s a common reason behind TPD claims, whether the loss is due to a traumatic workplace accident or a catastrophic road incident. The physical and emotional impact can be overwhelming, and for many, it’s not just about the pain or the daily challenges—it’s also about the worry of how they’ll continue to support their family.

The loss of a limb can severely limit your ability to perform even the most basic tasks. Suddenly, things that used to be second nature, like driving, lifting objects, or even typing, may become a huge struggle. For those whose careers relied heavily on physical ability, this loss often means an abrupt end to their working life.

If you’re facing this situation, a TPD claim could offer the financial support you desperately need. The process may seem daunting, but you’re not alone. We’re here to help you navigate the steps, understand your eligibility, and fight for the compensation you deserve, so you can focus on rebuilding your life and caring for your loved ones.

Success Stories: Real Examples of Successful TPD Claims

The Case

TPD claim stories involving serious illness are always heartbreaking, but there’s immense satisfaction in helping clients find financial relief during their toughest times. Lisa, a 38-year-old cash processor, faced a life-altering challenge when she lost her leg due to diabetes complications. Her recovery was grueling, requiring extensive rehabilitation.

On top of her physical struggles, Lisa developed severe depression and anxiety, making it impossible for her to return to work in any field she was qualified for. The mental and physical toll felt insurmountable.

The Outcome

Thankfully, Lisa reached out to Withstand Lawyers, and everything changed. Our experienced TPD team reviewed her case and meticulously managed her TPD application, collecting all necessary evidence and presenting it to her superannuation fund.

With our careful attention to detail, Lisa’s claim was approved in just a few months, and she was awarded a $300,000 TPD payout. While it couldn’t undo her trauma, the financial support gave her the stability to focus on her health and rebuilding her life. Helping clients like Lisa is why we do what we do, and we’re proud to have been part of her journey.

Click here to read more real world examples of successful TPD claims.

How can Withstand Lawyers help with your TPD Claim?

In this article, I’ve shared insights into the seven most common TPD claims I encounter as a TPD lawyer in Australia. If you or someone close to you is struggling with a condition that makes working impossible, we’re here to help. At Withstand Lawyers, we offer a free claim check to assess your eligibility and guide you through what can often be a complicated and stressful process.

What sets us apart is our No Win, No Fee promise. This means that if we’re unable to win your case (which rarely happens), you won’t have to pay any of our legal fees. We take pride in fighting for our clients’ rights, ensuring you receive the financial support you deserve without adding extra financial stress.

Get in touch with us today, and let’s start your journey toward securing the TPD benefits that could make a real difference in your life.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society