If you’ve come across the term “TPD” and are wondering about the TPD meaning, you’re not alone. TPD, or Total and Permanent Disability insurance, is a form of coverage designed to provide financial support when life changes drastically due to a permanent disability. This type of insurance can be essential for those who, due to severe injury or illness, find themselves unable to work and in need of a financial safety net.

In Australia, many people unknowingly have TPD insurance within their superannuation funds. But understanding the true TPD meaning—what it covers, who qualifies, and how it can help—can be a game changer when navigating uncertain times. In this guide, we’ll explore what TPD insurance entails, how it works, and how it could provide crucial support if you’re unable to work. Whether you’re exploring coverage options or just seeking clarity, this guide will walk you through the essentials.

What is Total and Permanent Disability?

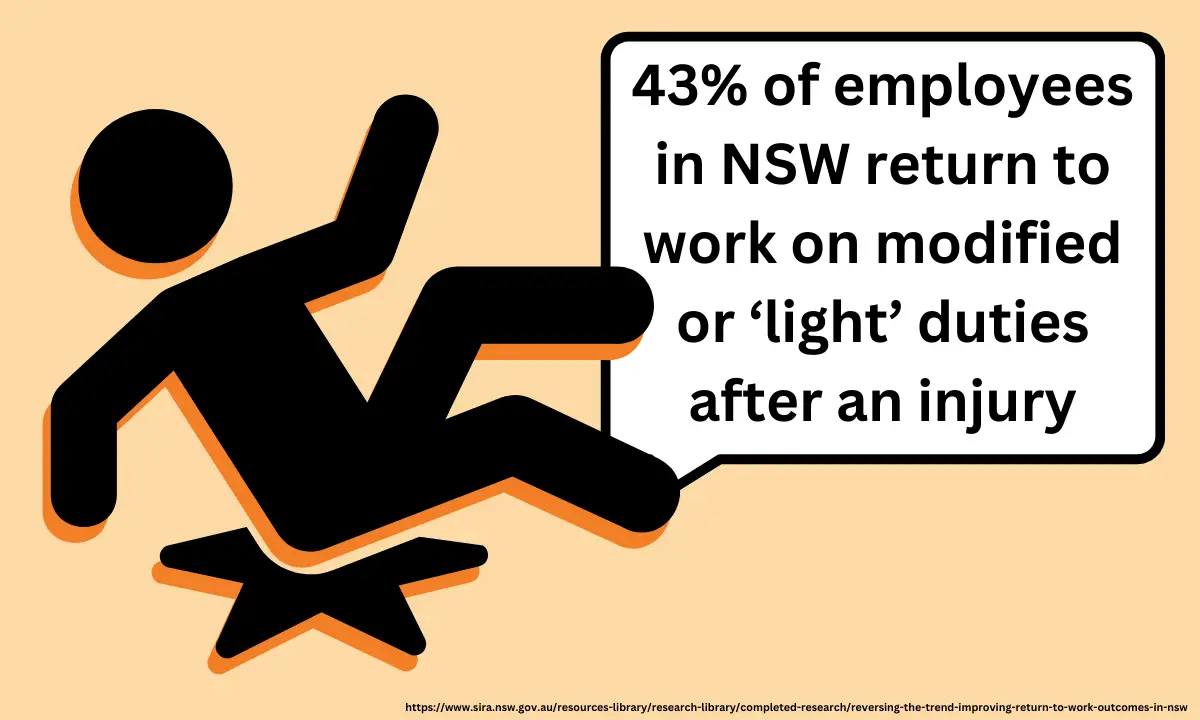

Total and Permanent Disability (TPD) refers to a condition where a person can no longer work in any job that matches their previous education, training, or experience due to a serious injury or illness. Importantly, this injury or illness doesn’t have to happen at work—it could result from any accident or health condition that makes it impossible to return to their former type of work.

While a person with TPD may still pursue new skills or a different type of job, they’re considered permanently unable to work in the roles they were once qualified for. TPD insurance offers financial support, helping cover living and medical expenses during this life adjustment.

What is Total and Permanent Disability Insurance Cover?

Total and Permanent Disability (TPD) insurance is a type of cover designed to provide financial support if you’re unable to work in any job that matches your prior education, training, or experience due to a permanent injury or illness. This insurance is meant to protect you financially if you can’t return to your former line of work, regardless of whether the condition was caused by an accident, illness, or other health issues unrelated to your job.

Key Features of TPD Insurance Cover

Many Australians may already have TPD insurance without realizing it. It’s commonly included by default in most superannuation (super) funds, meaning you’re often covered automatically unless you choose to opt out. This automatic inclusion makes TPD insurance a valuable safety net for individuals who haven’t taken out personal disability insurance policies.

TPD insurance provides a one-time lump-sum payment if you’re permanently unable to work in your previous field. This payment can help cover medical expenses, rehabilitation costs, and living expenses, allowing you to focus on your health and adapting to life changes without worrying about financial strain.

Am I Eligible to Make a TPD Claim?

TPD benefits are paid subject to different policies, as each one may have different eligibility conditions, definitions and terms. However, generally you are considered to be TPD if you :

- Stop work due to sickness or injury; and

- Do not work for an extended period of time (usually 3-6 months); and

- Are unable to return to work within your education, training and experience.

If you are unsure if you meet the requirements listed above, or if you are unsure if you have TPD insurance cover included in your superannuation, our TPD Lawyers are ready to assist you. Contact us today for a free eligibility check regarding your TPD insurance claim.

What does it mean when a TPD policy refers to “education, training and experience”?

TPD definitions can vary depending on your fund’s insurance policy. Most TPD insurance policies require that you stop working due to illness or injury and be permanently unable to return to work in your usual employment or any other employment that you are suited by your education, training and experience. That is why the superfund most of the times requests your resume.

Essentially this means that you are unable to work without being retrained or acquiring further education. That is, if you stop working in your own occupation because of an injury or illness, and you are unable to return to work in any occupation without acquiring further education or training, then you may be entitled to a TPD benefit. This part of the process is very important as it determines your eligibility to meeting the criteria and being eligible. Our TPD lawyers will assist you with ensuring you understand this and advise you whether or not you may be eligible based on your own education, training and insurance.

Understanding the Meaning of Double TPD Claims

Sometimes, people refer to making two separate TPD claims as a “double TPD.” This happens when someone holds TPD insurance with more than one superannuation fund. If you had TPD insurance coverage through multiple super funds as of your last working date, you may be eligible to make a claim with each fund. Each TPD claim is considered individually, so even if you have “double” or multiple TPD coverages, each fund will assess your eligibility separately.

Reasons for having multiple TPD coverages might vary—often, people don’t realize they’ve accumulated coverage through different super funds due to career changes or forgotten accounts. This “double TPD” setup means you are entitled to make separate TPD claims with each superfunds if you meet the eligibility criteria with each superfund. Our TPD Lawyers take pride in advising you to make a TPD claim with each superfund that you have a TPD Insurance policy with on a No Win No Fee basis.

Can You Claim TPD and Income Protection Insurance Together?

Generally you can claim both TPD (Total and Permanent Disability) insurance and income protection insurance together if you meet the eligibility criteria for each.

TPD insurance provides a one-time lump sum if you’re permanently unable to return to work in a job aligned with your skills and experience. In contrast, income protection insurance offers ongoing payments to replace a portion of your salary for a set period while you’re unable to work due to illness or injury, often on a temporary basis.

These two types of coverage complement each other, allowing you to receive immediate financial support through income protection while securing long-term stability through a TPD payout if you can no longer work permanently.

Can I Return to Work After My TPD Claim Has Been Approved?

In short, it depends on the TPD insurance definition within your funds’ insurance policy.

Each fund has its’ own TPD insurance definition and therefore, it is difficult to answer this question with certainty without reviewing your policy and circumstances. However, generally, the TPD meaning falls within one or more of the following definitions:

- Must not ever work again within your education, training and experience;

- Must not ever work again within your usual or own occupation;

- Must be unable to do your activities of daily living;

- Must lose the use of two limbs or your vision.

Therefore, provided you do not return to work within the area that was applied to your claim, you may be able to return to work after your TPD claim is finalised and you genuinely recovered or retrained in another area that you were deemed unable to work within prior.

Find out more about returning to work after a TPD claim here.

Why Choose Withstand Lawyers for Your TPD Insurance Claim?

Navigating a Total and Permanent Disability (TPD) claim can be complex and stressful, especially when you’re dealing with health challenges. Withstand Lawyers brings experience, compassion, and dedication to every TPD case, ensuring you receive the support you need during this crucial time. We offer:

- Expert Guidance and Knowledge: Our team of lawyers specializes in TPD claims, understanding the intricate requirements and working effectively with super funds to ensure your application is strong.

- No Win, No Fee Promise: We work on a No Win, No Fee basis, so you can confidently pursue your claim without the worry of upfront costs.

- FREE Initial Consultation: We offer a free eligibility check so you know your rights and where you stand with your TPD claim.

- Client-Centered Approach: We prioritize clear communication and ongoing support, making sure you feel informed and empowered every step of the way.

Contact us today on 1800 952 901 or fill out the form below to secure the best possible outcome for your TPD claim.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society