Life can change in an instant. One day, you’re working, earning an income, and planning for the future—then suddenly, an injury or illness takes that away. It’s a harsh reality that many Australians face, but Total and Permanent Disability (TPD) insurance exists to provide the financial support you need during difficult times.

But the big question is: What qualifies as a Total and Permanent Disability?

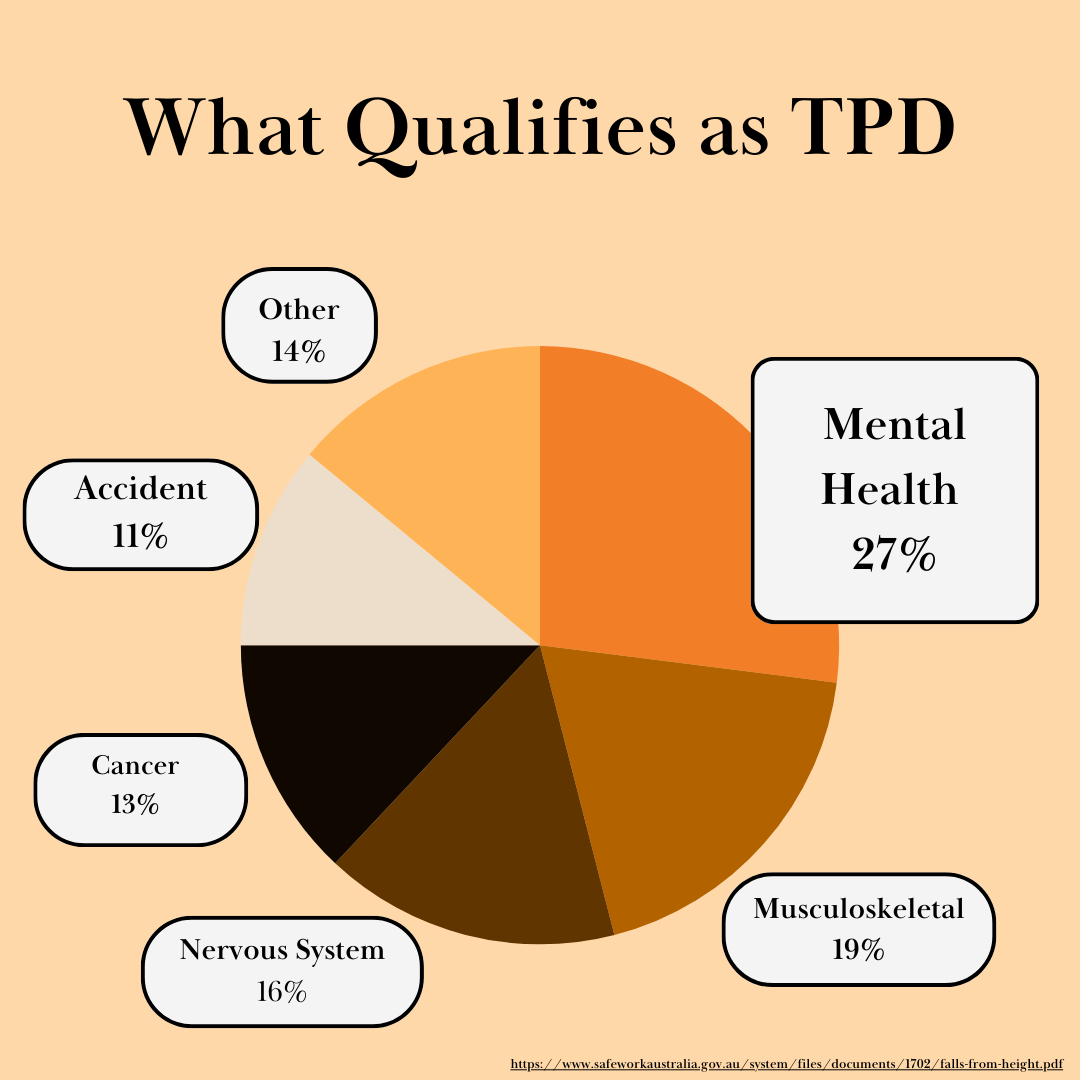

Many Aussies don’t realise their condition may actually qualify as a Total and Permanent Disability. You don’t have to be wheelchair-bound or bedridden to qualify for a TPD claim – mental health claims alone make up 24% and 27% of all TPD claims for men and women respectively.

Most Australians already have TPD insurance through their superannuation fund or private policy, yet many remain unaware of their right to claim. If your condition prevents you from working in your usual occupation—or any occupation suited to your skills and experience—you could be entitled to a significant payout to help secure your future.

In this guide we’ll cover:

In this guide, we’ll explain:

✅ What qualifies as a Total and Permanent Disability (TPD)

✅ The types of injuries and illnesses that may be eligible

✅ The different TPD definitions in superannuation policies

✅ What to do if you don’t know your super fund

✅ How Withstand Lawyers can maximise your claim – No Win, No Fee

A successful TPD claim can provide life-changing financial relief. Read on to find out if you qualify.

What is TPD and How Does It Work?

Total and Permanent Disability (TPD) is a legal and insurance term that describes a condition preventing you from working ever again in roles you have done before or have been trained to do.

If you suffer an illness or injury that leaves you permanently unable to perform work in your usual occupation—or in any occupation suited to your skills and education—you may be eligible for a TPD claim.

Your TPD insurance is often included in your superannuation fund or a private insurance policy, and it can provide a lump-sum payout to help cover medical expenses, lost income, and future living costs. Typical TPD payout amounts range between $40,000 and $350,000.

Do You Qualify for a Total and Permanent Disability Claim?

To qualify for a TPD payout, you typically need to prove:

🛑 You can’t return to your previous field of work – Either in your usual job or any job suited to your education, training and experience.

🩺 You have strong medical evidence – Reports from doctors, specialists, or other medical professionals confirming your condition will not improve.

⏳ You meet the waiting period – Most policies require you to be off work for at least three to six months before a claim can be made. This time period is necessary to show that your injury or condition is permanent. During this time, our TPD Lawyers could be preparing a claim to be on your behalf, during our free claim assessment period.

📄 Your superannuation fund or insurer accepts your policy terms – Different funds have different definitions of TPD, and it’s important that you meet the requirements of your specific policy to make a claim.

Many Aussies don’t realise their condition may meet the definition of Total and Permanent Disability. You don’t have to be wheelchair-bound or bedridden to qualify for a TPD claim.

Different TPD Definitions in Superannuation Policies

The definition of Total and Permanent Disability varies depending on your insurance policy or super fund. Understanding your policy’s criteria is crucial to a successful claim.

Own Occupation vs. Any Occupation TPD Definitions

- Own Occupation TPD – You qualify if you cannot return to your specific job due to your disability. This definition is easier to meet but is usually found in private policies, not superannuation-based cover.

- Any Occupation TPD – You must prove you cannot work in any suitable job based on your skills and education. This is harder to qualify for, as insurers may argue you can work in a different capacity.

Activities of Daily Living (ADL)

An Activities of Daily Living (ADL) test assesses whether you are unable to perform at least two basic tasks like bathing, dressing, feeding, toileting, or moving in and out of bed. If your TPD definition includes the ADL test and you meet this criteria, you may qualify for a Total and Permanent Disability (TPD) claim.

Click here to read more about the definitions of TPD found within different superannuation policies.

Common Conditions That May Qualify as TPD

Many people assume they need to be completely incapacitated to qualify for a total and permanent disability claim, but the reality is that a wide range of physical, mental, and neurological conditions can meet the TPD criteria—especially if they prevent you from returning to your usual job or any job suited to your skills and experience.

Here are some of the most common conditions that may qualify for a TPD payout:

Physical Injuries

Serious injuries that cause long-term physical impairment can make it impossible to continue working, especially in physically demanding jobs. Common conditions that may qualify as TPD include:

- Spinal cord injuries – Partial or complete paralysis, chronic pain, or mobility limitations

- Amputations – Loss of a limb or multiple limbs that prevent you from performing essential job tasks

- Chronic back or joint injuries – Severe injuries that make standing, lifting, or moving difficult

- Severe burns or disfigurement – If they limit mobility or affect job performance

- Permanent musculoskeletal damage – Such as injuries from workplace accidents, car crashes, or falls

Chronic Illnesses

Long-term, progressive diseases can prevent individuals from maintaining stable employment. Conditions that may qualify include:

- Cancer – Particularly if treatment side effects or disease progression make working impossible

- Multiple sclerosis (MS) – A degenerative disease that can impair mobility, coordination, and cognitive function

- Heart disease – Conditions like chronic heart failure, stroke-related complications, or severe arrhythmias

- Kidney disease or organ failure – If dialysis, transplants, or other treatments make regular employment unfeasible

- Autoimmune diseases – Such as lupus, rheumatoid arthritis, or fibromyalgia that cause chronic pain and fatigue

Mental Health Conditions

Mental health conditions can be just as debilitating as physical illnesses, yet many Australians don’t realise they may qualify for a TPD claim. If your mental illness prevents you from working in any occupation suited to your education, training or experience, you could qualify for a TPD claim. Common qualifying conditions include:

- Post-Traumatic Stress Disorder (PTSD) – Common among police officers, paramedics, and other first responders, making it difficult to return to work.

- Depression – Can result in hospitalisation and an inability to function in a work environment.

- Bipolar disorder – If manic or depressive episodes severely impact work capacity

- Anxiety disorders – Extreme anxiety or panic disorders that interfere with daily functioning

- Schizophrenia or other psychotic disorders – Conditions that impair reality perception and cognitive abilities

Neurological Disorders

Neurological conditions can significantly affect movement, coordination, speech, and cognitive function, making employment impossible. These may include:

- Stroke – If it causes lasting impairments in mobility, speech, or cognitive ability

- Traumatic brain injury (TBI) – Resulting in memory loss, concentration issues, or motor function impairment

- Dementia or Alzheimer’s disease – If cognitive decline makes it impossible to continue working

- Parkinson’s disease – A progressive condition that affects movement, balance, and coordination

Other Conditions That May Qualify

Even if your condition isn’t listed above, you may still be eligible for a TPD claim if it permanently prevents you from working. Other qualifying conditions may include:

- Chronic pain disorders – Conditions like fibromyalgia that cause persistent pain and disability

- Severe respiratory diseases – Such as chronic obstructive pulmonary disease (COPD) or pulmonary fibrosis

- Diabetes-related complications – If they lead to blindness, amputation, or nerve damage

There isn’t a strict list of injuries or illnesses that automatically determines what qualifies as a Total and Permanent Disability. If your condition prevents you from returning to your usual job—or any suitable occupation—you may qualify as TPD.

Click here to read more about examples that qualify as a total and permanent disability.

What If I Don’t Know My Superannuation Account?

Many Australians aren’t sure which super fund they’re with or whether they even have TPD cover. If this sounds like you, don’t worry—we can help.

At Withstand Lawyers, we can:

- Track down lost super accounts

- Check if you have TPD insurance

- Communicate with your super fund on your behalf

Even if you haven’t contributed to your super for years, you might still be covered. Contact us today to find out how we can help you make a claim, all on a No Win No Fee basis.

Will I Be Able to Work Again After a TPD Claim?

It’s a question many people ask when considering a Total and Permanent Disability (TPD) claim: “What if I get better? Will I be allowed to work again?”

The simple answer is yes.

A TPD payout is approved based on your condition at the time of the claim—not what may happen years down the track. The assessment looks at medical evidence to determine whether you are unlikely to return to work, but it does not mean you are permanently banned from working if your health improves in the future.

This is an important distinction because life is unpredictable. Some injuries and illnesses worsen over time, while others may improve with treatment, rehabilitation, or unexpected medical advancements. If you do recover—whether from a physical injury, a mental health condition, or both—you are legally allowed to re-enter the workforce without penalty.

If you have any concerns, our experienced TPD lawyers at Withstand Lawyers are here to support you. We’ll guide you through this challenging time, whether you’re dealing with a physical injury, a psychological condition, or both.

Why Was My TPD Claim Denied?

Having your TPD claim denied can feel frustrating and overwhelming—especially when you’re already dealing with the challenges of a serious injury or illness. Unfortunately, many claims are rejected for reasons that seem unfair, such as:

❌ Insufficient medical evidence – Even if your condition is severe, insurers may claim there’s not enough proof.

❌ Work capacity disputes – Insurers may argue that you can still work in some capacity based on the TPD definition in your policy.

❌ Paperwork errors or missed deadlines – A simple mistake can delay or even derail your claim.

At Withstand Lawyers, we know how insurers think—and we have the experience to maximise your claim. If your claim has been denied or delayed, don’t lose hope. We can review your case, strengthen your claim, and fight for the payout you deserve. Contact us today for a free assessment of your claim.

Why Choose Withstand Lawyers for Your TPD Claim?

Navigating a Total and Permanent Disability (TPD) claim can feel overwhelming—especially when you’re already facing serious health challenges. Many Australians struggle with confusing paperwork, delays, and unfair claim denials, making an already difficult time even more stressful.

At Withstand Lawyers, we’re here to take the burden off your shoulders. Our experienced TPD lawyers understand the complexities of the claims process and fight to ensure you receive the financial support you’re entitled to.

How We Help You Secure Your TPD Payout

✅ Experienced TPD Lawyers with Proven Results

Our team specialises in Total and Permanent Disability (TPD) claims and knows exactly how to navigate superannuation policies and insurer requirements. We prepare strong claims backed by medical evidence to give you the best chance of success.

✅ No Win, No Fee

Worried about legal costs? Withstand Lawyers works on a No Win No Fee Basis, meaning you never pay out of pocket.

✅ Free TPD Claim Assessment

Not sure if you qualify for TPD? We offer a free eligibility check, so you know where you stand before starting your claim. No obligations, no hidden fees—just straightforward legal advice.

✅ Clear Communication & Full Support

We know legal jargon can be confusing, which is why we keep things clear, simple, and transparent. From start to finish, our client-focused approach ensures you feel informed and supported every step of the way.

Get Started on Your TPD Claim Today

Don’t let insurers make the process harder than it needs to be. If you’re unable to work due to a serious injury or illness, you may be entitled to a lump-sum TPD payout. Call us now on 1800 952 898 or fill out the form for a FREE claim assessment.

At Withstand Lawyers, we fight for your rights—because your future matters.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society